SME fund 2023

The 'ideas powered for business' SME fund is established to improve access to intellectual property rights for small or medium-sized enterprises (SMEs) in the European Union.

The programme is an initiative of the European Commission and the European Union Intellectual Property Office (EUIPO) in cooperation with the national intellectual property offices, including the Belgian Intellectual Property Office (IPObel).

Intellectual property rights, and more in particular patents, are quite expensive. Before casting them off as not being worth the investment, have a look at the many financial measurements provided by the authorities that will turn your patent into profit. Both federal and regional measurements support SMEs and large companies in taking and maintaining intellectual property rights.

Fiscal advantages of IPR in Belgium

Deductions for innovation-related revenues

Since July 1, 2016, Belgian companies or foreign companies with an establishment in Belgium can benefit from tax deduction for innovation profits, referred to as innovation income deduction. Up to 85% of a company’s net profit resulting from innovation is exempt from corporate taxation.

Which companies?

Belgium-based and foreign corporations with a fixed Belgian seat.

What?

- patent

- complementary protective certificate

- plant breeders' right

- copyright-protected software

- orphan drugs

- data and/or market exclusivity for crop protection agents, medicine for human or animal use

Conditions

The deduction is 85% of the net revenue based on the intellectual property right and applies from the application date of the IPR in question. The non-used deduction is transferrable to the following fiscal periods.

In the case of copyright-protected software, it has to be the result of a research or development project/program.

Read more

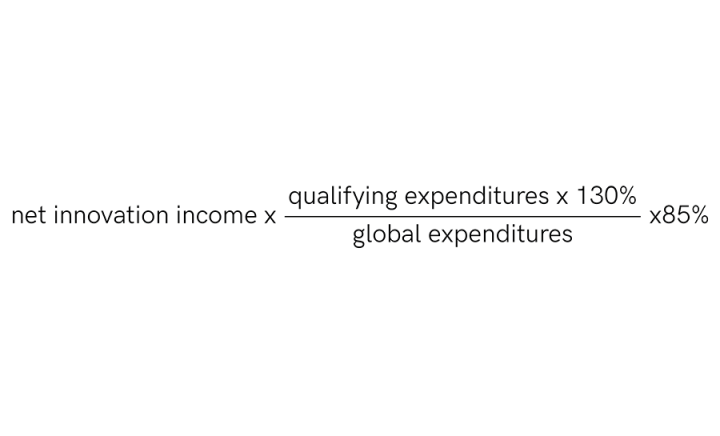

Innovation income deduction: caluclation

The innovation income deduction is calculated on the net income generated by the qualifying intellectual property (IP) rights (“net qualifying income”). Net qualifying income equals the gross IP income minus current-year expenditures for the development of the IP asset. Such qualifying expenditures include R&D expenses related to qualifying IP rights, expenditures for the acquisition of IP rights, expenditures for R&D outsourcing to related or unrelated parties, and prior-year expenditures incurred in financial years ending after June 30, 2016. The recapture of the latter expenses can be spread over a maximum of 7 years.

The result of the fraction is capped at 1, as the maximum exemption level amounts to 85% of the net qualifying income.

There are special documentation requirements for companies that want to apply the innovation income deduction. All elements used for the calculation of the innovation income deduction, such as gross IP income and R&D expenses related to qualifying IP rights, must be documented.

VLAIO

kmo-portefeuille

The pillar "advice" of the kmo-portefuille allows the financing of advice on intellectual property by recognized service providers of 40% for small companies (max. € 10.000) and of 30% for middle-sized companies (max. € 50.000).

Innovation subsidies

In the context of an "innovation" dossier subsidized by the Agency Innovation & Entrepreneurship, the costs to protect the results of an innovation by IPR, are financed to a maximum of € 20.000 to cover the preparatory cost, such as a freedom to operate research, and costs related to registration and the drafting of the dossier (with the exception of maintenance costs and costs in the case of a juridical dispute. The amount of the support is between 35 and 80%, depending on the type of the dossier.

Support to IPR efforts in the Walloon Region

The support of patent deposition is restricted to financially sound SMEs with a exploitation seat in Wallonia and includes three categories:

- Patent Deposition (filing) (PATDE)

- Patent Expansion (PATEX)

- Patent Opposition (PATOP)

BENEFICIARY: Company

RATE OF ASSISTANCE: 75 %

MAXIMUM AMOUNT OVER 3 YEARS: €45,000 EXCL.

If you are the author of an invention, you would probably like to know if your invention is patentable, or if someone might oppose it.

The Intellectual Property Cheque allows you to be assisted in these matters by our specialist, Madeleine Wéry, who can also help you to have an overview of all existing patents and documents concerning the field of your invention. This first "state of the art" can then lead to a "patent mapping" to analyse in depth all references related to your invention, in order to help you in your strategic decision making.

This check is only available to SMEs registered as a commercial enterprise in the ECB.